General Actions:

12.2:11 Taxation

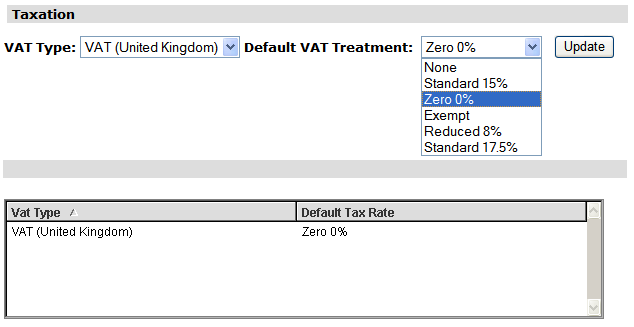

The Taxation screen allows a default Tax Treatment to be assigned directly to the supplier, to be applied (depending on other default overrides) on every item added to a requisition for the supplier.

Since the purchase from certain suppliers may materially affect the Tax treatment and therefore the accounting of an order, it is expeditious to allow an override based on the supplier. Assigning a default to the supplier removes the dependency on users having to select the correct Tax treatment when ordering goods from these exceptional suppliers, especially when there are occasions when users are not aware of the requirement to change Tax treatment.

A default Tax treatment can also be assigned to commodity codes and the user’s default business rule group to override the organisational default. The full hierarchy for the Tax default is as follows:

- Commodity Code

- Supplier

- Default Business Rule Group

- Organisation

To assign a default tax code to the supplier:

- Click the Taxation button to open the supplier Taxation screen.

- Select the Tax Type from the drop down box.

- The available Tax Treatments for the selected Tax Type will display in a drop down list box. Select the required treatment that is to be the default for the supplier.

- Click the Update button. Upon initial insertion of a VAT Treatment, the system will display a message “Inserted Successfully”.

- Click Insert (if inserting a new profile) or Update (if editing an existing profile) for the supplier to finally save the tax default to the supplier profile.

- Only one tax treatment can be applied to each supplier profile but the default can be changed at a later date by simply selecting an alternate treatment from the drop down box and clicking ‘Update’.

Navigation

P2P Admin