General Actions:

4.4.2 Tax Treatments

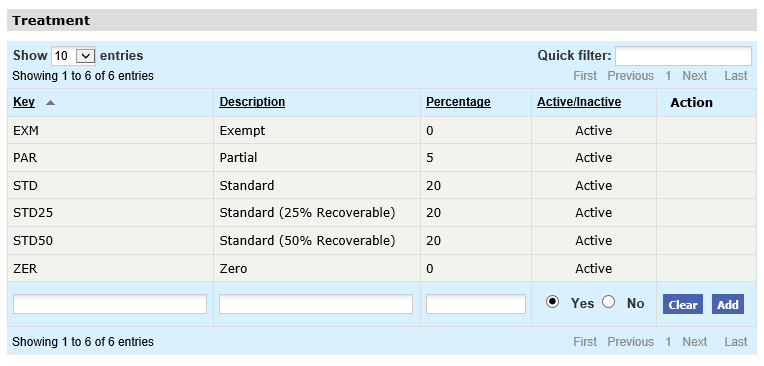

Some Tax Types (e.g. United Kingdom VAT) allow for the assignment of Tax Treatments. Tax treatments are the tax codes to be used during the procurement and invoicing process to be made available to users. Not all tax types will allow for the entry of treatments.

To add tax treatments for a tax type click on the tax type in the ‘Selected Tax Types’ box. If treatments are allowed for this tax type an additional ‘Treatment’ form will appear at the foot of the page for the entry and maintenance of tax codes.

Search and Filter

The Tax Types table will display 10 entries, sorted alphabetically, by default but can be extended using the Show entries control in the top left hand corner of the table. Using the list box, choose an override to display 25, 50 or 100 entries. When more than one page is available, pagination controls will display the number of pages of entries and allow you to scroll or jump between those pages. A Quick filter provides a 'type ahead' text search, which automatically filters the entries in the table using the string of characters entered.

For each Tax Code (Treatment) the following information must be given:

- Key: A financial system identifier. The key is used by the PECOS P2P database and must be unique value for each Tax Code. Once in use the key cannot be edited.

- Description: The name of the Tax Code. This field is not unique and can be edited at any time.

- Percentage: The percentage used by PECOS P2P to calculate the tax value in the invoice posting and matching screen. Once the tax code is in use the percentage cannot be edited.

The Tax description field is displayed to the user in the requisition module and therefore it might be a good idea to include rate percentage details in the description.

After entering each code click ‘Add’. When all codes are entered click ‘Save’ at the top of the page to commit the changes.

Editing Codes

Tax Keys and Percentages cannot be edited, only Descriptions can be updated. Select an existing Tax Treatment, update the description and click the ‘Update’ button. When you have completed your changes click ‘Save’ at the top of the screen to save your work.

A Tax code cannot be deleted. To deactivate a code, click on it in the existing codes box and check the ‘Inactive’ radio button. Save your change by clicking ‘Save’ at the top of the page. An inactive code can be reactivated by following the same procedure and checking the ‘Active’ radio button.

Navigation

P2P Admin