General Actions:

4.4.1 Tax Types

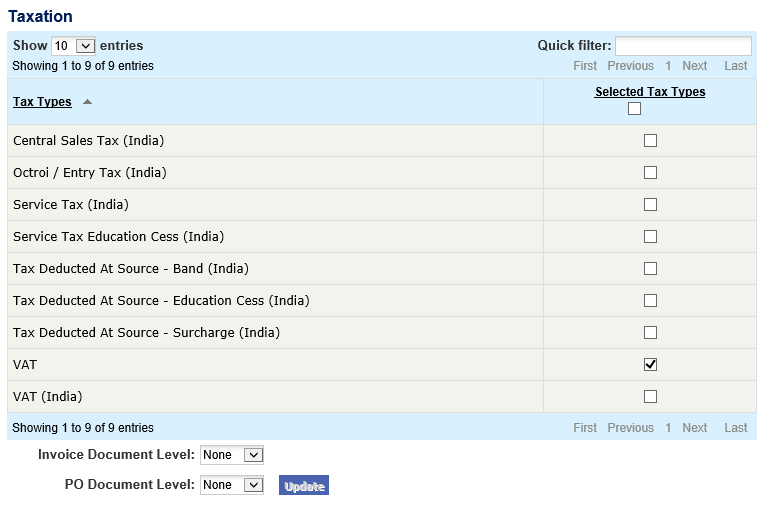

Tax Types are used to define how PECOS P2P manages, calculates and displays taxation and are selected according to the jurisdiction, territory or locality of your implementation.

Note that the default tax for PECOS P2P is US Sales Tax and it is not necessary to select a Tax Type when implementing in the USA and adopting this default tax regime.

Search and Filter

The Tax Types table will display 10 entries, sorted alphabetically, by default but can be extended using the Show entries control in the top left hand corner of the table. Using the list box, choose an override to display 25, 50 or 100 entries. When more than one page is available, pagination controls will display the number of pages of entries and allow you to scroll or jump between those pages. A Quick filter provides a 'type ahead' text search, which automatically filters the entries in the table using the string of characters entered.

Available Tax Types

The following Tax Types are available:

- VAT (United Kingdom): Select for United Kingdom implementations of PECOS P2P to invoke full Value Added Tax features. UK VAT is buyer selectable and Tax Treatments are required to be entered for this tax type which will enable users to assign VAT codes to items on the requisition and invoice.

- VAT (India): Select for implementations in India where Value Added Tax is used. This will enable VAT to be entered or edited on invoices. No Tax Treatments are allowed.

- Central Sales Tax (India): Select for implementations in India where Central Sales Tax is used. This will enable CST to be entered or edited on invoices. No Tax Treatments are allowed.

- Service Tax (India): Select for implementations in India where Service Tax is used. This will enable ST to be entered or edited on invoices. No Tax Treatments are allowed.

- Service Tax Education Cess (India): Select for implementations in India where Service Tax is used. This will enable Education Cess to be entered or edited on invoices. No Tax Treatments are allowed.

- Octroi (India): Select for implementations in India where Octroi is used. This will enable Octroi to be entered or edited on invoices. No Tax Treatments are allowed.

- TDS Band (India): Select for implementations in India where TDS withholding tax is used. This will enable TDS to be entered or edited on invoices. No Tax Treatments are allowed.

- TDS Education Cess (India): Select for implementations in India where TDS withholding tax is used. This will enable Education Cess to be entered or edited on invoices. No Tax Treatments are allowed.

- TDS Surcharge (India): Select for implementations in India where TDS withholding tax is used. This will enable TDS Surcharge to be entered or edited on invoices. No Tax Treatments are allowed.

To select a tax type, follow these steps:

- In the Taxation screen click on a tax type to be implemented in the ‘Existing Tax Types’ box.

- Move the tax type to the Selected Tax Types box using the move one (>) arrow. All tax types can be selected using the move all (>>) arrow.

- Click the Update button.

- Click Save to commit your changes.

Maintenance Level

After selecting the Tax Type(s) to be used it is important to define where the tax will be maintainable for override purposes, when a user has appropriate permissions. There are two document levels for tax maintenance by the user:

- Invoice Document Level. This will define how tax will be maintained within the invoice screens (invoice entry and editing).

- PO Document Level. This will define how tax will be maintained within requisition and purchase order screens There are four levels to choose:

- None. This is the default. Tax is not displayed at either the header or line level.

- Header. Tax is displayed at header level and the user is able to override the system assigned default.

- Line. Tax is displayed at line level and the user is able to override the system defined default. Note that not all tax types support line level entry and this option may not be available.

- Both. Tax is displayed at both the header and line level and the user is able to override the system defined default.

Navigation

P2P Admin