General Actions:

4.9.2 Taxation

Taxation

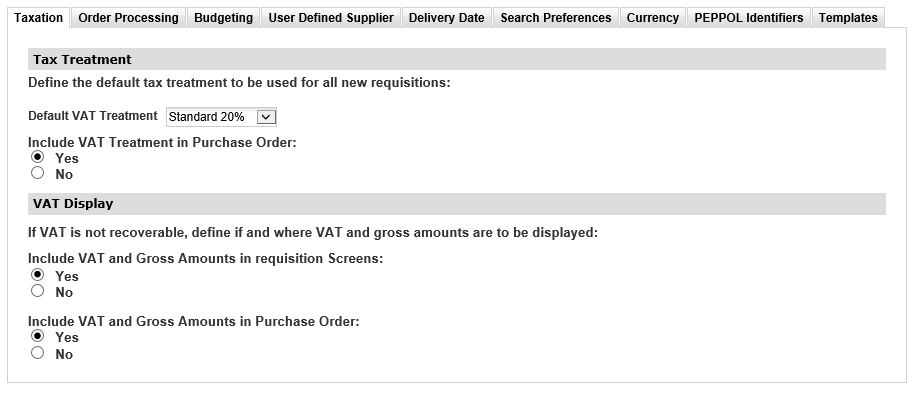

A number of tax treatment and display options are presented in the Taxation tab of the Organisation Settings screen to define how VAT is managed organisationally in PECOS P2P.

Tax Treatment

Tax Treatment settings define the default tax code to be used as the top organisational default and whether or not tax is to be displayed on purchase orders that are transmitted to suppliers.

VAT Default

Select the organisational default Tax Treatment (e.g. UK VAT) by choosing it from the drop down list. These Tax types must first have been entered in the Taxation page in Organisation Maintenance.

- A different default Tax Treatment can be set for each organisational level.

- The default is not mandatory and may be left empty if no default is required or it is to be set elsewhere.

- If no default is assigned, PECOS P2P will use the parent or grandparent(s) default setting.

- Note that this organisation level default is superseded by defaults set within product classification codes, supplier profile and business rule groups.

Include VAT Treatment in POs

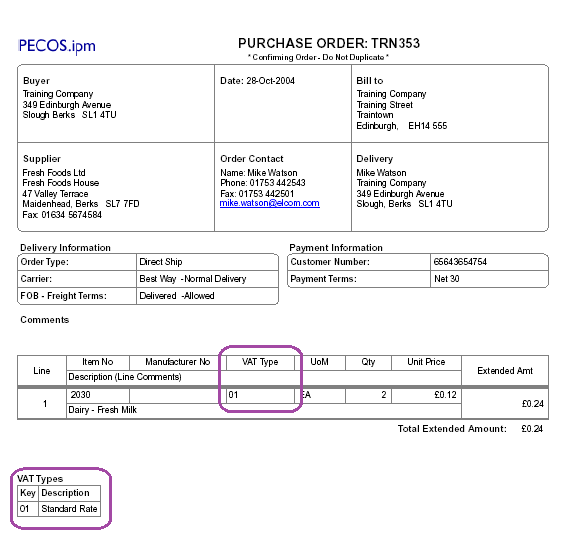

Choose whether the Tax Treatment (e.g. UK VAT) is displayed on Purchase Orders for this organisation level. Including the Tax Treatment on the PO will add the tax treatment key to both the eMail and the outbound cXML purchase orders (depending on which order transmission method is selected for the supplier).

The tax amounts that apply to each line are NOT calculated at this stage and are NOT included on the PO.

- Yes: The Tax treatment key is displayed for each order line and the Key Description defined at the bottom of the Order.

- No: The Tax treatment key is not displayed for each order line.

- Default from Parent (Default): The parent organisation setting will be used.

The following is an example of the Standard Purchase Order Template where UK VAT has been selected to be included:

VAT Display

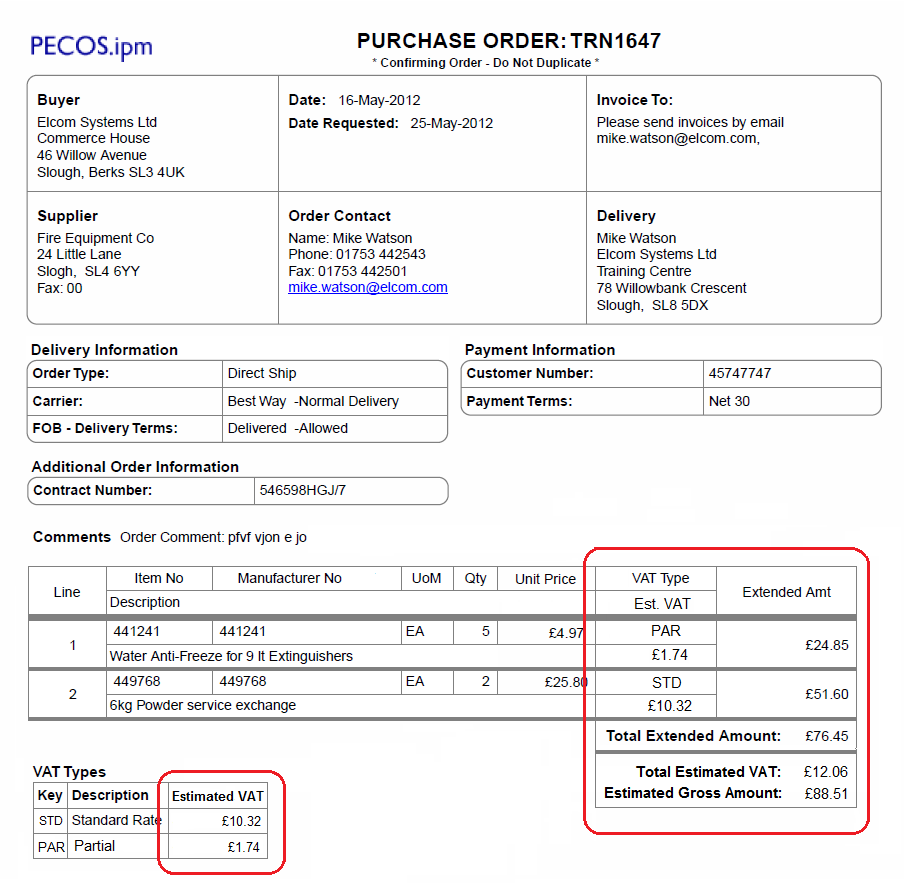

An estimated amount of VAT is calculated at the point of requisition creation based upon the tax type associated to each item. For organisations who cannot recover some or all of their VAT, it is possible to display these VAT Amounts and a Gross Totals on requisition, order request and purchase order screens.

VAT is calculated as follows:

- When an item is added to a requisition the system calculates an estimated amount of VAT in the supplier’s default currency.

- When an item is edited or updated in a requisition, order request or change order, the system recalculates the estimated amount of VAT and replaces the original estimated value.

- The estimated VAT calculation is based upon the tax treatment assigned to each item id. The estimated tax is the tax treatment percentage multiplied by the item extended amount. Normal tax default rules apply when ascertaining the default tax treatment.

- Total order tax is the sum of all estimated line amounts and total requisition tax is the sum of all the order tax amounts.

VAT is displayed as follows:

- If an item has no tax treatment assigned to it, the estimated tax will display as zero and the estimated gross value will be the same as the extended amount.

- If there are no estimated tax amounts calculated for any line on an order the estimated tax amount in the order header will display as zero and the estimated gross amount will be the same as the order total.

- If there are no estimated tax amounts calculated for any line on a requisition the estimated tax amount in the requisition header will display as zero and the estimated gross amount will be the same as the requisition total.

A number of screens are affected including:

- Requisition: Requisition, Requisition Review, Requisition Status Summary, Returned Requisition Summary and Returned Requisition Editing.

- Requisition Approval: Requisition Approval Editing and Requisition Approval Summary.

- Order Request: Order Request Status Summary, Returned Order Request Summary and Returned Order Request Editing.

- Order Request Approval: Order Request Approval Editing and Order Request Approval Summary.

- Change Orders: Purchase Order Change, PO Change Approval Editing, Returned PO Change Editing, PO Change Review, PO Change Approval Summary and Returned PO Change Summary.

- Blanket Orders: Blanket Order Summary, Blanket Order Detail and Blanket Order Release.

- Receipts: Receive Items.

Two options control the view of VAT and Gross amounts in Organisation Settings.

Include VAT and Gross Amounts in Requisition Screens: enables the display of fields in requisition, order and approval screens (i.e. all screens with the exception of the PO Template). Two options are available, presented as radio buttons:

- Yes: The VAT display option is turned on and the system will display VAT amounts and gross values

- No: The VAT display option is not turned on and the system will not display VAT amounts and gross values. This is the default.

Include VAT and Gross Amounts in Purchase Order: enables the display of fields in the standard purchase order template. Two options are available, presented as radio buttons:

- Yes: The VAT display option is turned on and the system will display VAT amounts and gross values.

- No: The VAT display option is not turned on and the system will not display VAT amounts and gross values. This is the default.

The following is an example of the Standard Purchase Order Template with VAT and Gross Amounts included:

Navigation

P2P Admin