General Actions:

4.4.3 Matching Tolerance

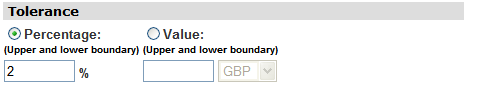

A tolerance level can be set for VAT

This tolerance level (percentage or absolute value) is used by the Invoice Matching logic to determine whether there is a difference between the Calculated Tax value and the Supplier entered invoice value. If the tolerance is exceeded the match will fail and the invoice placed on an exception status.

- Percentage: Enter a decimal number to be applied as a percentage tolerance.

- Value: Enter a decimal number to be applied as an absolute amount. A Currency must also be selected, which will determine what invoices this tolerance will be applied (i.e. only invoices in this currency).

Note that Tax tolerances are not used for ERS suppliers since there is no supplier entered VAT for a variance to be calculated.

Navigation

P2P Admin