General Actions:

7.2 Review Invoices

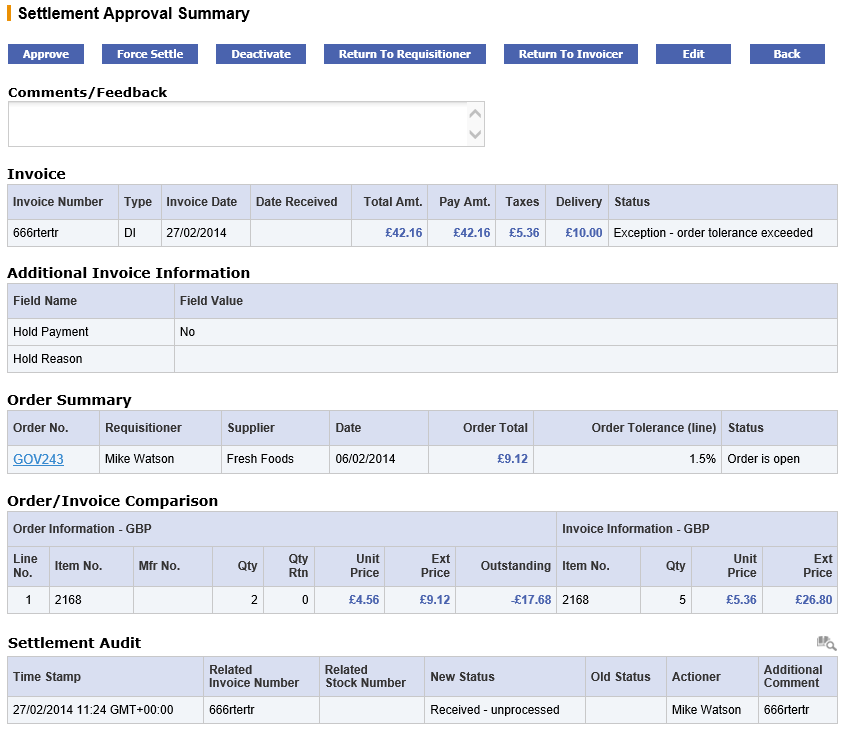

In the Settlement Approval Summary screen scroll down the document details to review and consider an appropriate course of action.

The summary screen contains all the necessary information for an approver to make an informed and accurate decision.

- Invoice. The invoice header details include invoice dates, total amount, total taxes, delivery charges and the current invoice status.

- Settlement Status. The settlement status of the invoice, displayed in the invoice header, is a very important piece of information that will probably explain why this document has been sent to you and will determine your course of action (see Invoice Settlement Statuses).

- Additional Invoice Information. Any user defined invoice fields will appear in this section. These fields have been extended by your system administrator to capture additional information for use during workflow approval or for passing through to your finance system.

- Order Summary. The order summary section contains details of the order, including the line level matching tolerance that has been used. This tolerance is the maximum value above and below the order value outside of which the invoice value will be placed on a mismatched status.

- Order/Invoice Comparison. This table contains line item level detail of: the order quantity and prices and invoice quantity and prices that have been used in the financial matching process.

- Invoice Attachments. This table contains a list of attachments that are associated to the invoice: for example, a copy of the original paper invoice received from the supplier. An attachment may be ‘Manual’ (added by the invoicer through the PECOS P2P invoice entry form) or ‘Electronic’ (added automatically through the eInvoice interface). The attached file can also be either an office document or a URL. Click on the file description to open, review or print the attachment.

- Settlement Audit. The settlement audit trail provides a date stamped history of invoice processing.

- Order Audit. The order audit trail provides a date stamped document history. This contains important information relating to approvals, receipts, returns, invoicing and matching and will probably indicate why the invoice has been sent to you for approval or review: read the actions carefully.

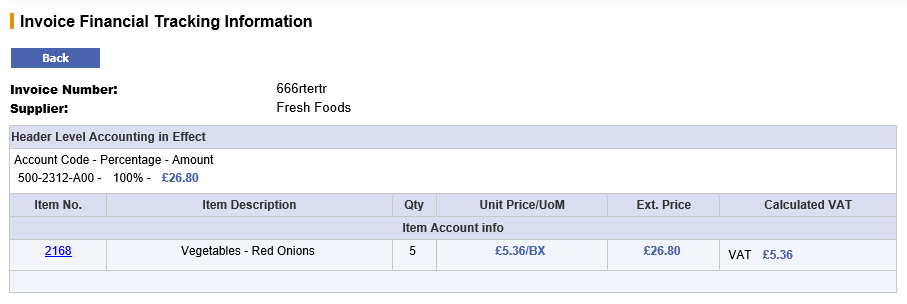

- Financial Tracking. Click on the financial tracking icon to open and review the financial tracking and tax information for the invoice.

Invoice Settlement Statuses

The following settlement statuses may be displayed for each invoice in the Settlement Approval Summary screen. These statuses are provided to give an indication of the current matching and settlement processing stage of individual invoices. A purchase order may have multiple invoices, each containing different settlement statuses.

- Exception - Full match pending receipt: (Note that three-way matching is being used by the order). The invoice has been matched and an invoice exception recognised: at least one line on the invoice contains a quantity that is greater than the receipt quantity for the line. Full receipting or force settlement is required in order for this invoice to be paid.

- Exception - Order tolerance exceeded: The invoice has been matched and an invoice exception recognised: at least one line on the invoice contains a price that is greater or less than the order price. Force Settlement is required in order for this invoice to be paid.

- Mismatch between order and invoice (for non tolerance errors): The invoice has been matched and an invoice exception recognised: at least one line on the invoice contains a quantity greater than the net order quantity (original order quantity less returns). Force Settlement is required in order for this invoice to be paid.

- Exception - VAT tolerance exceeded: The invoice has been matched and an invoice exception recognised. The total VAT entered on the invoice as ‘Supplier VAT’ exceeds the amount of system generated ‘Calculated VAT’ by more than the VAT tolerance. Force Settlement is required in order for this invoice to be paid.

- Reconciled: The invoice has been matched and there are no exceptions. This invoice can be paid and will be included on the next APExport.

- Reconciled - pending full invoicing: The invoice has been matched and there are no exceptions. The supplier has been configured to NOT allow ‘Partial Delivery Payment’ and therefore PECOS P2P has identified that the invoice quantity is less than the order quantity. This invoice cannot therefore be paid until all invoices have been received for this order and the total invoice quantities equal the net order quantity. This invoice will not be included in the APExport until all invoices for this order have been received and reconciled, when all invoices have been sent together.

- Force settled: The invoice has been matched and an exception identified but this has been approved by the running of the Force Settlement program. This invoice can be paid and will either be included in the next APExport (if the invoice is not in approval routing) or is in settlement workflow awaiting approval.

- Deactivated: The invoice has been deactivated during the settlement process and no longer requires approval or settlement. This invoice should not be paid and will not be included in an APExport.

- Returned to invoicer: The invoice has been returned to the invoicer (the user who created the invoice) during the approval process. The invoice will reside in the Invoicers To Do list until it is edited and reprocessed.

- Returned to requisitioner: The invoice has been returned to the requisitioner (the user who created the invoice) during the approval process. The invoice will reside in the requisitioner’s To Do list until the original purchase order has been changed and/or reprocessed.

Navigation

P2P Approvals