General Actions:

5.7 Display VAT and Gross Amounts

For organisations that have UK VAT enabled, your system administrator may have implemented the display of 'VAT and Gross Amounts'. If so, the system will calculate an estimated amount of VAT at the point of requisition creation based upon the tax type associated to each item and display VAT and Gross values on the face of the requisition and in the requisition submitted screen.

Ordinarily, item extended amounts in all requisition and purchase order screens are calculated and displayed net of VAT. Only VAT treatments are (optionally) displayed on the purchase order and VAT is only calculated and displayed in the invoice entry screen for validating the supplier entered VAT amount.

Enabling the display of VAT and Gross Amounts benefits those organisations that are unable to recover all or some of their VAT (e.g. educational establishments or charities). By displaying gross amounts these organisations are able to determine more accurately the total value of expenditure. VAT amounts are also displayed during the routing of requisitions and purchase order requests for approval.

The following are summary examples of how the display of VAT and Gross Amounts could be utilised:

- An organisation that is unable to recover VAT will be able to display tax values and gross amounts on requisitions to ensure that requisitioners procure accurately within a gross expenditure budget.

- An organisational division that is unable to recover VAT is able to provide approvers with gross requisition totals for approval to ensure that expenditure is based on the true cost to the division.

- An asset management or technology department that is able to track the true cost of capital expenditure by including VAT amounts in requisitions and purchase orders.

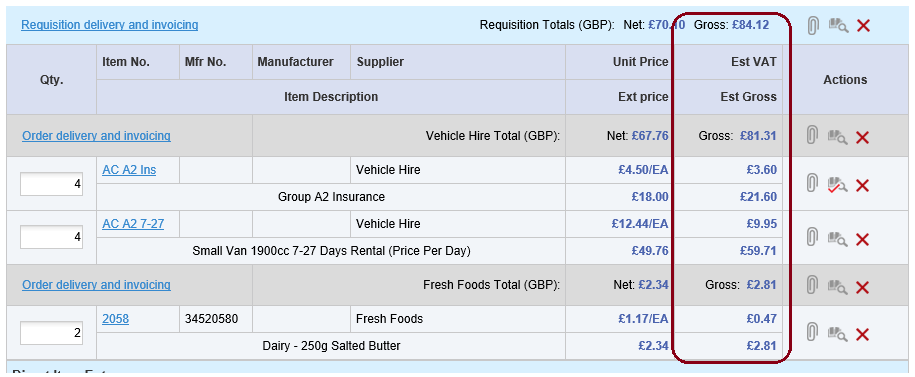

5.7.1 Requisition Screen

When this feature is enabled, a Gross Price column appears in the requisition screen and displays the following amounts:

- Gross Requisition total (in the requisition header row)

- Gross Order total (in the order header row)

- Tax amount on the extended price (at line level)

- Gross extended amount (at line level)

Existing requisition and order totals are displayed as ‘net’ values.

5.7.2 Requisition Review Screen

When this feature is enabled, the following fields appear in the Requisition Review screen:

- Requisition Detail:

- Estimated Tax amount for the whole requisition

- Gross Total for the whole requisition

- Order Detail:

- Estimated Tax amount for the order

- Gross Total for the order

- Order Line Detail

- Estimated Tax amount on the extended price

- Estimated Gross extended amount

5.7.3 Requisition Submitted Screen

When the VAT and Gross amount display feature is enabled, the Requisition Submitted screen displays a gross total for each order request generated.

Navigation

P2P Procurement